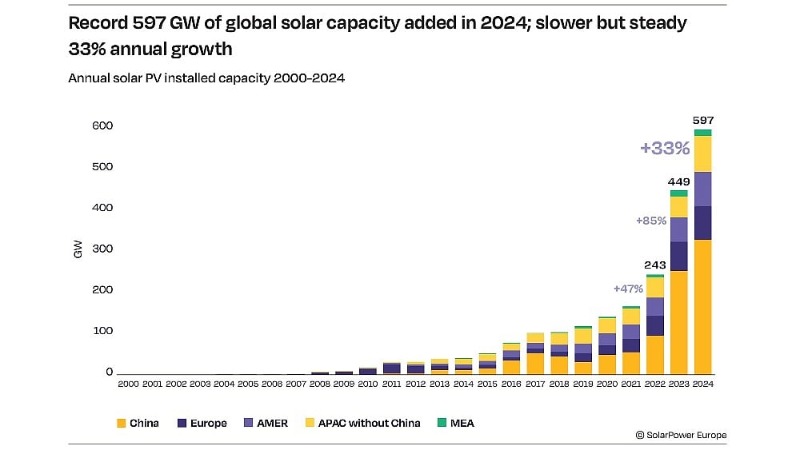

SolarPower Europe's latest Global Photovoltaic Market Outlook is like a double-edged sword - the expected installed capacity of 655GW by 2025 not only indicates the explosive power of the industry, but also hides structural crises. When the global cumulative installed capacity exceeds the 2.2TW mark, the photovoltaic industry is standing at a turning point from quantitative change to qualitative change.

China's Largest Single-Unit Floating Photovoltaic Power Station: Anhui Fuyang Southern Wind-Solar-Hydro Power Base's Water Surface Floating PV Plant(650MW) ---Source: Media News

Regional differentiation in the third-order growth curve

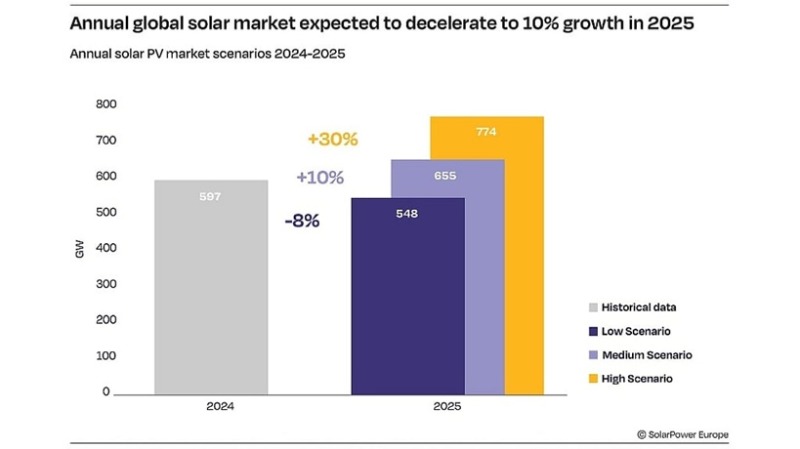

In its Global Solar Market Outlook report, three scenario forecasts are provided. Under a neutral forecast, the global installed capacity of photovoltaics is expected to increase by 10% year-on-year to 655GW by 2025, while a conservative forecast is for 548GW, a decrease of 8% year-on-year; In an optimistic scenario, if component prices remain low and coupled with China's policy stimulus, the annual new installed capacity is expected to reach 774GW, a year-on-year increase of nearly 30%.

The three scenarios outlined in the report are actually stress tests of the global energy transition process:

1. China's unipolar drive: Under the influence of the new policies of 430 (projects that have previously completed filing or grid connection can continue to use old policies, such as full grid connection mode, simplified filing process, etc.) and 531 (new grid connection projects need to implement the following new regulations: strict differentiation of filing subjects; adjustment of grid connection mode; market-oriented trading of electricity, etc.), and the installation frenzy caused by the 23% year-on-year decline in module prices in the first half of the year, the problem of distributed photovoltaic grid connection and consumption has become urgent;

European policy cliff: The fragility of the 13% share is highlighted, and the lagging implementation of policies by member states may cause a sharp drop of 40% in annual new additions, repeating the trajectory of the 2023 UK market crash;

3. Energy storage card battle in the Americas: With a market share of 14% and a 4-hour energy storage ratio becoming the new normal, the internal rate of return of photovoltaic storage projects in the ERCOT market in Texas has exceeded the critical point of 9%.

Of particular note is that in the 4% share of the Middle East and Africa, the Saudi Arabia "2030 Vision" project cluster contributes over 60% of installed capacity, but the PID attenuation rate of components caused by desert environments is 2.8 times higher than that in temperate regions, which poses technical risks.

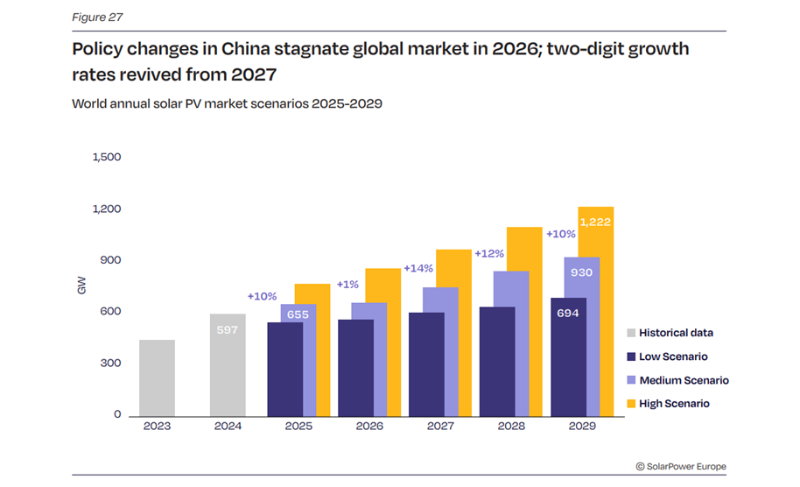

The transmission chain of growth stall in 2026

The report's warning of a 1% growth rate cliff in 2026 is actually a resonance product of policy cycles and technological iterations:

1. China subsidy switch: transition from fixed electricity prices to premium mechanisms, triggering a 6-9-month wait-and-see period for developers, expected to result in a 35GW installation gap;

Source: SolarPower Europe

2. European trade barriers: The comprehensive implementation of CBAM carbon tariffs has led to a sharp increase of 11% in component production costs, coupled with the rollback of the REPowerEU plan, resulting in a demand suppression of 15GW;

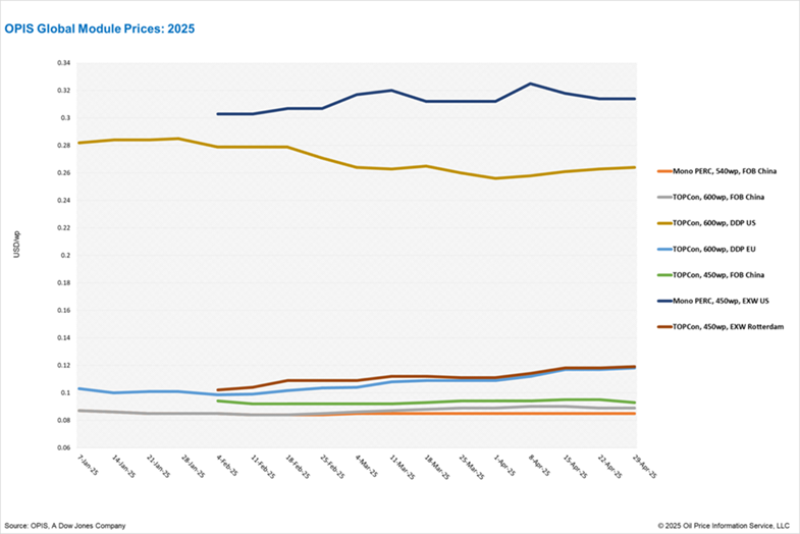

3. Technological generational replacement: TOPCon's production capacity ramp up overlaps with HJT's mass production window, triggering a wave of equipment technological upgrades and posing a risk of 200GW of existing capacity being stranded globally.

This cyclical adjustment coincides with the revision of tax credit provisions in the US Inflation Reduction Act, and under the triple impact, the beta coefficient of photovoltaic stocks may exceed the 2.0 warning line.

Structural contradictions and breakthrough paths

Faced with the expected growth of 755-930GW from 2027 to 2029, the industry needs to solve three major paradoxes:

1. Scissor difference between cost and quality: The current component price of $0.12/W is approaching the cost line of silicon materials, but new attenuation mechanisms such as LeTID increase the implicit cost of LCOE in power plants by 1.2 cents/kWh;

2. Tension between concentration and distribution: The cost of land for centralized power plants in China has risen by 178% in three years, while the European distributed market is facing technological bottlenecks in grid reverse flow;

3. Misalignment between innovation and standards: The mass production efficiency of perovskite components has exceeded 18%, but has encountered a lag in IEC standards, resulting in a 40% decrease in insurance institutions' willingness to underwrite.

The key to breaking the game is hidden in the integration of digital technology:

1. Intelligent operation and maintenance revolution: With the application of software systems such as AI, artificial intelligence, digital twins, and cloud edge collaboration in power plant operation and maintenance, it can not only reduce the failure rate of power plants, but also greatly improve operational efficiency;

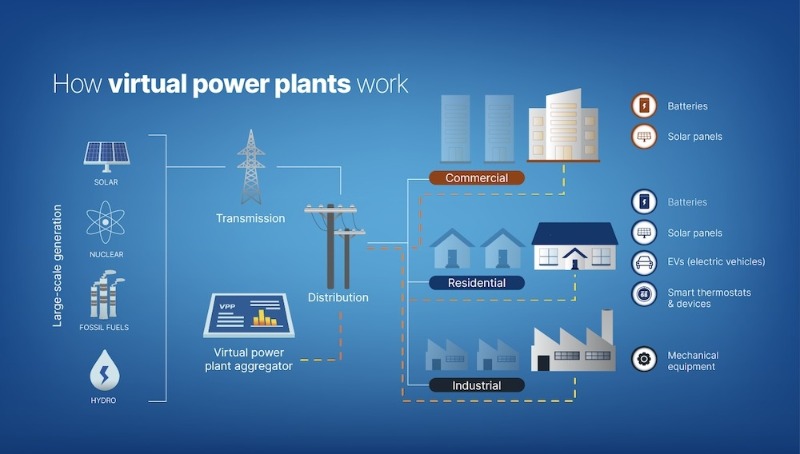

2. Integration of virtual power plants: Aggregate distributed photovoltaics, other forms of electricity, and energy storage to form unified coordination and control, create regional virtual power plants, and actively participate in electricity spot market transactions to increase profits;

Source: www.solarreviews.com

3. Green finance innovation: The average maturity of photovoltaic asset securitization products has been extended from 7 years to 15 years.

When the global photovoltaic industry reaches the TW level threshold for annual additions, industry competition has shifted from capacity competition to ecosystem construction. Chinese companies need to be wary of the 'scale trap', the European market urgently needs to break through the 'last mile' of policy implementation, and emerging markets face technological adaptation challenges. In this energy revolution intertwined with zero sum game and positive sum evolution, only by piercing through the fog of short-term fluctuations can we seize the strategic opportunity of structural restructuring.